Precious metals are very lucrative and profitable investments. The ability of these commodities to retain their value despite the situation of the economy is one of the reasons savvy investors are investing in these items.

If you want to join this rank of elite savvy investors, you must not dive in blindly. Despite the low risk of these commodities, it is wise to apply prudence as you would with any other type of investment.

Therefore, we have compiled a few important questions you need to ask yourself before you invest in precious metals. When you successfully answer these questions, you will be able to make a well-informed investment decision.

Let us get started…

Should I go Physical, Paper, or Digital?

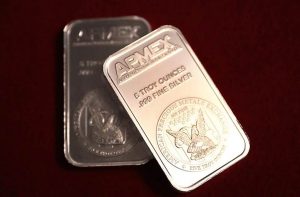

When it comes to investing in these valuable items, many folks prefer keeping the gold themselves. This form of investment involves having access to these physical items. Check out Enterprise Bullion to learn more on how to invest in bullion precious metals.

If you choose to go for digital gold, you enjoy this liability advantage as well. However, you do not have access to the physical item. You only trade and store the items digitally on the platform of your choice.

If you go for paper gold which includes futures and certificates, you do not enjoy the above liability advantage. In this case, paper investments do not have the backing of the physical metal. Hence, you do not have ownership of the item, and you do not have the opportunity to exchange the paper gold for physical gold or any other metal. You should bear in mind that when you choose paper gold, you become an unsecured creditor.

When it comes to this choice, we recommend you only invest in physical gold that allows you to have direct ownership. You can also go for one with the backing that allows you to exchange for physical commodities or redeem it for physical items.

Do I Want Unallocated or Allocated Metals?

When we talk about unallocated metals, we are referring to precious metals that are unsegregated (counterparty risk) and do not grant the investor ownership title.

Apart from these, investment vehicles sometimes bestow the investor with claims that surpasses the overall amount of the principal metal. Furthermore, if bankruptcy or issuer insolvency occurs, you could end up becoming an unsecured creditor.

On the other hand, allocated metals are regarded as generally safe. They are segregated and offer you full ownership title. Precious metals in this category cannot be leased or lent to any third party.

We advise that you only go for fully allocated precious metals that provide the best security, are free from encumbrances, and bestow full ownership that will not surpass the overall amount of the principal metal.

What is the Mark-Up Price Compared to the Spot Price of the Metal?

A mark-up price of 2% – 8% is attached to the acquisition of any of these metals in either bar or coin form. This mark-up is usually different from the spot price. Visit https://economictimes.indiatimes.com/definition/spot-price to learn more about spot price. Therefore, you need to be aware of the difference between both prices. Factors that affect the price difference include dealer inventories, volume, purity, and rarity.

If you purchase ETFs, the difference between both prices will not be so much. However, a management fee is usually charged annually. The costs this fee covers include trading, insurance, storage, trustee oversight as well as shareholder reporting. The fee also covers the manager’s profit.

If you choose closed-end funds, although they are like ETFs, however, you can trade at substantial discounts compared to the metal’s principal spot price.

As a result of the difference between the mark-up and the spot price, it is best you compare dealers’ prices when you want to buy coins or bars. This will allow you to choose the best option from the lot.

If your plan is to hold the commodity for just a couple of years, then you should compare the overall costs of mark-up plus mark-down to the management fees for owning the investment.

Where Will My Metals be Stored?

Owning precious metals gives you a hedge against financial risk. Hence, you need to store the items in a depository that provides you with less risk as well.

Therefore, you should consider where you will store the items. You should look out for storage providers that offer you insured storage. If you get an ETF, you should ensure that you select a provider that stores your metals at reputable bullion banks.

To further ensure the safety of your items, you should make sure that the bank does not hire sub-custodians to store their bullion. Such an additional layer adds additional risk.

We need to mention that this action is legally permissible for bullion banks to do; however, it is best you choose one that does not.

Can I Receive the Delivery of the Precious Metals?

Investing directly in bars and coins is the best method to receive the physical delivery of your assets. Nevertheless, you will have to deal with mark-ups, going to the dealer, and selecting the storage place.

Most bullion ETFs prevent an average investor from receiving delivery of their assets. However, for certain Authorized Participants (usually bullion banks), this option is available for creating brand new units. On the other hand, closed-end funds permit you to receive delivery of your assets.

Your selection in this case is something you should consider carefully and decide on based on your overall investment plans and goals.

What Ongoing Costs Should I Expect?

Ongoing costs that are attached to the physical possession of these items include storage and insurance. As we mentioned earlier ETFs as well as closed-end funds have a management fee that you will pay annually.

When you consider this question, you should compare the fees from different dealers. However, do not allow price to be the determining factor, also consider features and risks differences.

Conclusion

In the article above, we have discussed some important questions you should ask yourself before investing in precious metals.